Morning Market Thoughts

Morning Market Thoughts:

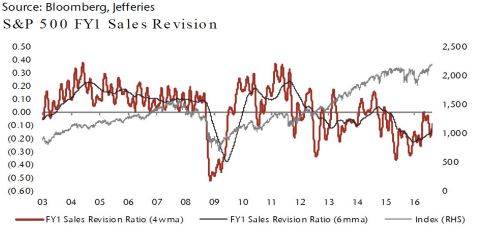

This morning I was reading a piece from Jefferies global equity team. I tend to like their pieces because they are typically two pages long, having some very good facts and stats, and have charts that make you go “Hm”. Earnings now wrapping up to the final few companies reporting, Jefferies had a rather good chart on the S&P 500’s sales revision ratio both on a 4 week moving average and a 6 month moving average. Here it is:

We see that the 4 week moving average has defiantly picked up from the 20015 lows and the 6 month moving average is improving nicely. The question that arises from this chart is Why? Why is this improving? The answer is comes from another chart featured in the Jefferies note:

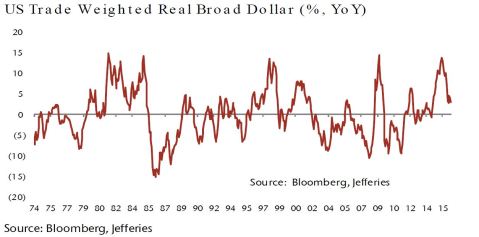

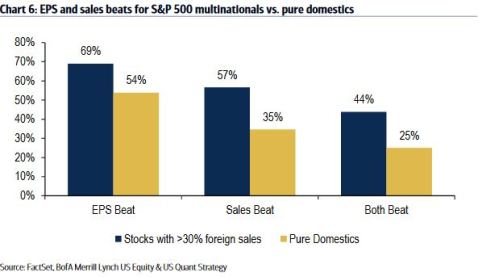

Ah yes! The almighty dollar. Whats so important is that this chart of the dollar is that it focuses of the Year over Year rate of change. We see that there was a sharp move higher from 2014-2015 and that we are starting to get back to that 0% Year over Year change. With this change in the dollar appreciation we have also heard less of the Dollar in earnings calls. I remember over the last two years that the play was to switch into more pure domestic companies so you didn’t have to worry about the dollar affecting earning as much. But now we have a significantly less move in the Dollar on a Year over Year basis and the result……. Not a lot of mentions about the dollar on conference calls and you would have to really search to hear about another fact. That fact is that Multinationals absolutely kicked Pure domestic company’s butt when it came to earnings this quarter, take a look:

It is in my opinion that this lack of move in the dollar is defiantly one of the reasons why earnings were so good this quarter and that we have seemed to emerge from the earnings recession we were in.

Questions and comments are always welcome

WillHassellws@mail.com