watchlist for 10/27/2013

what im looking at for this next week

Position Update

a quick position update

position change

today I took advantage of a weak opening in micheal kors, ticker symbol $KORS. i did this because i have wanted to get back in it after i dumped it during the government shutdown volatility, it was moving very sharp to the downside at that point. since then it has been a straight line up and hasn’t really stopped, it report earnings on November 5th. I’m anticipating that they will beat on earnings since they are a amazing growth story and have captured just how to get consumers to buy their products even though they are high end products. I got in today at $76.85 when it was in the red it closed at $78.70, so already have some small gains.

Watchlist

This week I would like to turn your attention to a stock i have been long for almost two years now. This stock is J.P. Morgan ticker symbol is JPM. Unlike my last post which was TSLA which was suppose to be for a short term play. JPM is for a multi month to multi week play that you could be long in and feel safe. JPM posted earning on Friday that came in at a beat on expectations, but still had a loss of $380 million 17 cents a share which was the first ever loss under their CEO Jamie Dimon. In my opinion Dimon is one of the best CEO’s on the planet. The reason why they posted the loss in earnings was the 9 billion in legal fines they paid to the government. One was because of bad mortgages/ mortgage back securities that they had because they acquired Bear Stearns during the financial crisis, I dont think it was fair that that the government went after them for that. Trading for the bank was still pretty good and if you look past the legal fines you find that they a very strong bank. If you think, as I do, that there wont be anymore legal trouble that was this big then it is a definite buy. Especially when you realize that they only had a 380 million loss because they had 9 billion in legal fines, if you take away the fines they would have had a massive profit for the quarter.  on the chart you notice that both the 100 and 50 day moving averages are starting an upward trend. This indicates that there is momentum in the stock toward the upside. A key thing to watch for on the chart for a short term play is the crossing of the 10 and 50 day moving average, in this case its the 50 day crossing up above the 10 day. This typically means that the longer term trend is continuing past that short term trend line, in this case it means that JPM will continue to go higher on a longer time frame then on the short one. That is one of the reasons that I said its more of a multi week to multi month play. All and all JPM is a great bank and has preformed well, the loss the quarter wont mean too much because JPM is going to tighten up because of it,

on the chart you notice that both the 100 and 50 day moving averages are starting an upward trend. This indicates that there is momentum in the stock toward the upside. A key thing to watch for on the chart for a short term play is the crossing of the 10 and 50 day moving average, in this case its the 50 day crossing up above the 10 day. This typically means that the longer term trend is continuing past that short term trend line, in this case it means that JPM will continue to go higher on a longer time frame then on the short one. That is one of the reasons that I said its more of a multi week to multi month play. All and all JPM is a great bank and has preformed well, the loss the quarter wont mean too much because JPM is going to tighten up because of it,

position change

Today i cut both my position in $KORS and $TSLA. I saw them as a lot of risk so I cut them. i made profits on both, check my profit ly for the numbers. ( http://profit.ly/user/WillHassellws ) i dont know if i would get back into $TSLA i would only for a small trade. $KORS on the other hand i would get back into, im using $70 as a place to watch. Today showed something, that if you have profits sometimes its good to take profits and run.

Watchlist

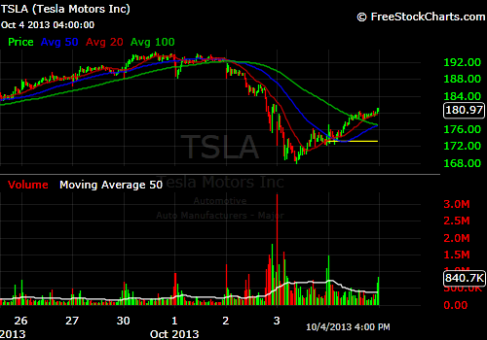

I have been long TESLA since earlier this month and i have been actively trading this stock since july only keeping the position for up to about three weeks. This week TSLA saw some pain because of a video that showed a tesla on fire. the shorts went all over this and the stock had two days of 4% declines, but on Friday rallied back up to $180. If you didn’t buy one of the two declines i would buy it right here, every time TSLA goes down by more then 4% it rallies for along time til the next drop. If you look at the charts of tsdla from the last four months you will notice that it has a few big drops every so often then keeps on rallying. i think this is because a lot of people take profits at those time and the stock needs some time to breathe.  If you look a the char you will see the multi day decline that happened last week as well as Friday’s rally. A key thing to watch is the 50 day moving average if you notice its about to cross the 100 day, normally when this happens it means some short term momentum until a longer trend is made. For TSLA short term momentum can mean a move of $20 in four days. I would say buy this on Monday because a lot of shorts will be covering and a lot of new money will be coming in.

If you look a the char you will see the multi day decline that happened last week as well as Friday’s rally. A key thing to watch is the 50 day moving average if you notice its about to cross the 100 day, normally when this happens it means some short term momentum until a longer trend is made. For TSLA short term momentum can mean a move of $20 in four days. I would say buy this on Monday because a lot of shorts will be covering and a lot of new money will be coming in.

https://twitter.com/WillHassellws

https://twitter.com/WillHassellws

follow me on twitter for all my thoughts and real time moves

http://profit.ly/user/WillHassellws/dashboard

http://profit.ly/user/WillHassellws/dashboard

follow all of my trades both present and past