Productivity

http://www.bloomberg.com/news/articles/2015-07-30/the-next-president-must-avoid-the-jimmy-carter-malaise Great article by Tom kneene who is the host of bloomberg surveillance. This article goes into details about the lack of productivity in the post-crises US compared to 1970s. Recently the measure of productivity has been called into question as to how accurate it is to our modern day economy. The best argument that I have heard for this was on Bloomberg’s what did you miss; where goldman’s chief economist showed game play of the first grand theft auto compared to the most recent grand theft auto, he says that productivity doesn’t include various modern technology updates such as software. Pretty interesting to think about the difference in productivity if we include that.

Divergence Occuring?

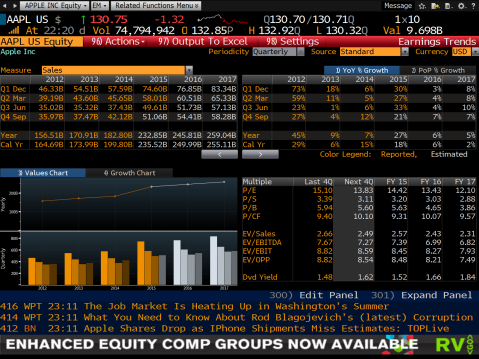

So we are mid earnings season and as earnings are reported investors are thinking about changing up their portfolios accordingly. I for one went into $XLV (the healthcare spider etf) because they have the highest earnings revisions of any other sector in the S&P. BAML had a fantastic note this monday all about earnings so far when it comes to beats in terms of EPS, sales, and % that beat on both. Here are some experts:  Here we see that large cap is beating all others

Here we see that large cap is beating all others  Here we see that quality beats in all, but in sales beat percentage

Here we see that quality beats in all, but in sales beat percentage  And here we see that foreign sales is beating pure domestic despite the strong dollar This got me thinking about how investors having been seeing things like large cap growth vs large cap value or small cap growth vs large cap growth. So did some digging and pulled up some cool charts.

And here we see that foreign sales is beating pure domestic despite the strong dollar This got me thinking about how investors having been seeing things like large cap growth vs large cap value or small cap growth vs large cap growth. So did some digging and pulled up some cool charts.  First we are looking at the Morningstar large cap value total return index vs the Morningstar large cap growth index in a one year chart. Here we see that Growth (orange) has been a clear out performer over value. Whats interesting is that it changed from the year trend of value leading right at the beginning of July. Here we have the same indexes, but for small caps. Here we see yet another reversal of value leading, this time it comes early June.

First we are looking at the Morningstar large cap value total return index vs the Morningstar large cap growth index in a one year chart. Here we see that Growth (orange) has been a clear out performer over value. Whats interesting is that it changed from the year trend of value leading right at the beginning of July. Here we have the same indexes, but for small caps. Here we see yet another reversal of value leading, this time it comes early June.  Here we see the same large cap indexes, but this time it is a two year chart and here we see that big shift we saw from value to growth has been this big in over two years.

Here we see the same large cap indexes, but this time it is a two year chart and here we see that big shift we saw from value to growth has been this big in over two years.  Here is the same small cap indexes as before, but this time its a three year chart and we see, much like with large caps, that the move in growth over value hasn’t happened in years.

Here is the same small cap indexes as before, but this time its a three year chart and we see, much like with large caps, that the move in growth over value hasn’t happened in years.  Credit where its due. This was actually the chart of the day by Hedgeye and it partially inspired me to do this post. They observed the something in the Russell 1000 value and growth indexes as I observed in the morningstar indexes. This is a five year chart and now you can tell why I used the two and three year charts for the previous ones because its hard to see the divergence.

Credit where its due. This was actually the chart of the day by Hedgeye and it partially inspired me to do this post. They observed the something in the Russell 1000 value and growth indexes as I observed in the morningstar indexes. This is a five year chart and now you can tell why I used the two and three year charts for the previous ones because its hard to see the divergence.  Here is the zoomed in version of the chart to show you the divergence. I find this move between value and growth, in both large cap and small cap, to be very interesting. For years in this bull market we have heard that people keep paying up for growth and it now seems like that is finally coming true and its something to think about. You have to ask yourself, if people are really starting to pay for growth, what happens when growth slows or disappoints? I’m, not saying it will or it won’t, I’m just saying to think about it.

Here is the zoomed in version of the chart to show you the divergence. I find this move between value and growth, in both large cap and small cap, to be very interesting. For years in this bull market we have heard that people keep paying up for growth and it now seems like that is finally coming true and its something to think about. You have to ask yourself, if people are really starting to pay for growth, what happens when growth slows or disappoints? I’m, not saying it will or it won’t, I’m just saying to think about it.

What Im Reading This Morning

Thoughts from Paul Tudor Jones (BI)

The importance of intellectual honesty in the markets (@awealthofcs)

Carlyle Hedge Funds face withdraws (WSJ)

Tweet:

https://twitter.com/FerroTV/status/625988101945602049

In honor of China’s markets, song:

What Im Reading This Morning

China’s markets were 😦 last night (WSJ)

Edward Jones is pushing prop funds (Advisorhub)

Kyle Bass video is EPIC (ValueWalk)

Tweet:

Song:

What Im Reading This Morning

78 year old is starting a hedge fund (WSJ)

Man do I love Tom Keene’s pieces (Bloomberg)

A second Tom Keene piece (they are really that good) (Bloomberg)

Jim Grant still likes gold, Fed needs to raise rates, Like NOW!!!!!!!!! (ValueWalk)

Tweet:

What Im Reading This Morning

Best time to be a young investor (Maliceforall)

Bridgewater flips view on china (WSJ)

BOFA keeps firing/ losing Merrill advisors (Advisorhub)

Barclays to cut 30k jobs? (BI)

Tweet:

EURUSD 1 month Risk-Reversal skew smallest since early 2014… if you are bearish, puts be cheap.. http://t.co/n9aga0fZfl—

Jeremy (@JeremyWS) July 23, 2015

Song: https://www.youtube.com/watch?v=QCKEaM2SlbI Straight fire

What Im Reading This Morning

Another big short coming? (WSJ)

Can you believe everyone is talking about apple? (BI) (I am long this stock)

Fed has been hurting savers (@awealthofcs)

tweet:

This chart from Evercore ISI indicates US recessions preceded by surging not weak commodity prices.. http://t.co/r2l02VS55N—

Shane Oliver (@ShaneOliverAMP) July 21, 2015

What Im Reading This Morning

A win for Human Hedge funds! (WSJ)

A look inside MS and their new style (Advisorhub)

Financial Times for sale? (Bloomberg)

Tweet:

What Im Reading This Morning

Doff and Frank talk about Dodd-Frank (WSJ)

Gold flash crash? (BI)

The biggest risk right now? (@awealthofcs)

Greek banks are open! (Bloomberg)

Tweet:

What Im Reading This Morning

China pours $483 billion on stock market (Bloomberg

A visual history of market predictions (Fund Reference)

More on Icahn vs Blackrock (WSJ)

VIX and crash scares (@callieabost)

Tweet:

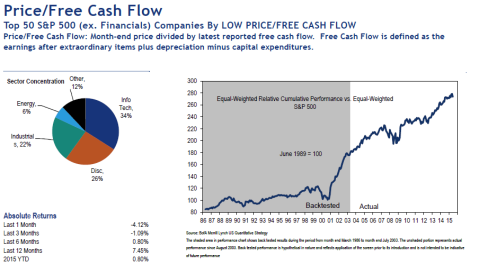

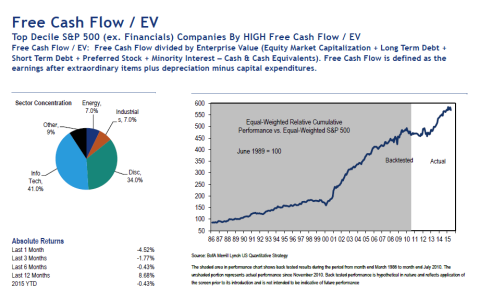

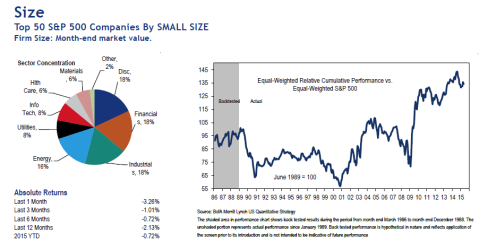

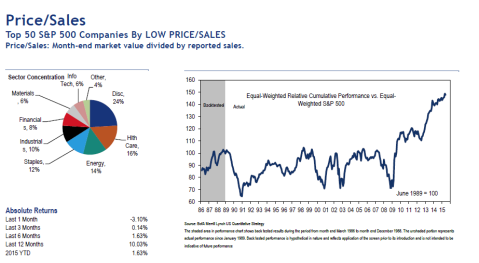

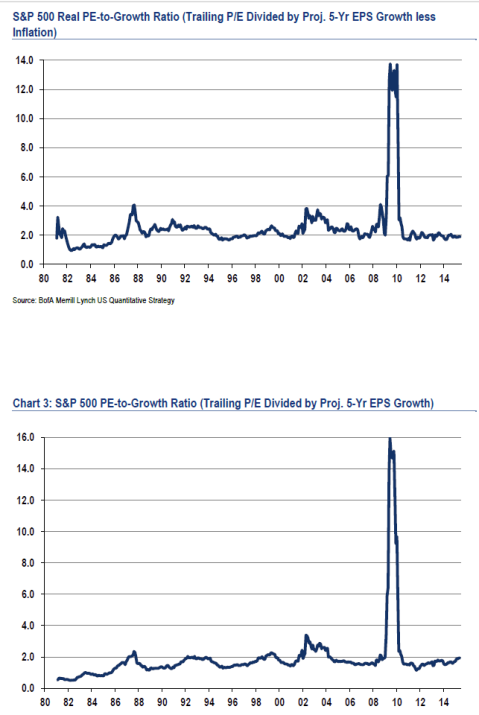

chart time!!!!!!!!: A look at the best quant strategies from BAML’s note “A guide to stock picking”

Cash is king….

size matters

sales do too

and some valuation metrics