What Im Reading This Morning

Greece is getting into trouble if deal cant be made (Bloomberg)

Holding Opposing Investment Ideas (@michaelbatnick)

Today is Quodwitching, so learn what it is (CNBC)

Tweet:

What Im Reading This Morning

Greece drama continues (WSJ)

UBS apparently told dealers to fix LIBOR (Bloomberg)

A Wall Street Legend dies (BI)

Tweet:

You could say that EUR higher means EZ stocks lower.. but also EZ stocks lower means people un-hedge & buy euros! http://t.co/ZFsr10v5Je—

(@MacroLlama) June 18, 2015

My Fed Day Predictions

-Yellen raises rates up to 1%

-Greece declares they wont ever pay back IMF or EU money

-They leave the Euro zone

-Japan announces that they will do QE infinity

-Dinosaurs at the new theme park “Jurassic World” break free from their cages (Dont worry im long some puts)

-California suffers from massive earthquake and drifts off into the Pacific ocean

-Martians invade

It is going to be a busy afternoon so get ready!

What Im Reading This Morning

What Would Yale do if it was Taxable? (Wealth Management.com)

Floods Allow Zoo Animals To Roam Free (CNBC)

AdBlocking Raises Consumer Content Prices (Bloomberg)

Tweet:

https://twitter.com/ReformedBroker/status/610412001106522112

What Im Reading This Morning

Credit Suisse is kinda sure we are in a stock bubble (BI)

Two More Years of Bull? (TRB)

Pimco May Have Averted Fire sale post Gross exit (Bloomberg)

Tweet:

Import Prices vs CPI: "Give me your tired, your poor, your deflation." If dollar stops going down, CPI will explode. http://t.co/K3qdykLZhn—

Two And Twenty (@deuxetvingt) June 11, 2015

What Im Reading This Morning

How the Next Financial Crisis Will Happen (WSJ)

Charts that have Jeff Gundlach thinking bonds will end right where they started (BI)

Closet Technicians (The Irrelevant Investor)

Amari (Japan Econ Minister) "Kuroda didn't intend to move the market with his remarks" http://t.co/QYq8wszJDS—

Jonathan Ferro (@FerroTV) June 10, 2015

What Im Reading This Morning

http://www.bloomberg.com/news/articles/2015-06-08/deutsche-bank-s-surprise-ceo-pick-brings-turnaround-track-record (bloomberg)

http://www.wsj.com/articles/calpers-to-cut-external-money-managers-by-half-1433735976 (WSJ)

http://traderfeed.blogspot.com/2015/06/markets-trading-and-investment-new.html (@steenbab)

US ACT 10Y Term premium at such low levels – 10y German/US tightener good expression to upside inflation surprises? http://t.co/bnT4SYwRRO—

Jere Wilkinson-Smith (@JeremyWS) June 08, 2015

Taper Tantrum ?

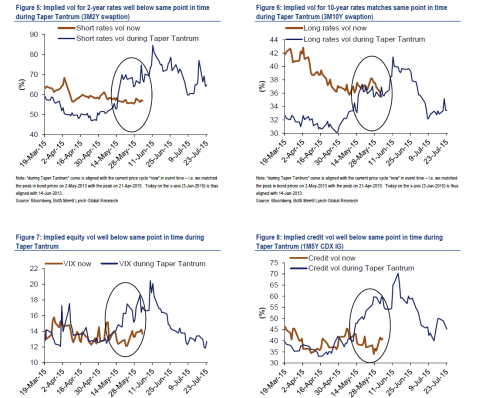

Could we be seeing the start of another taper tantrum like move in rates, currencies, and stocks? If you were around when the Fed announced they were going to start Tapering QE a couple of years ago in June then you saw what was a crazy couple of days. Rates spiked, currencies were making big swings, and stocks slid about 5% in two days. It looks like we may be setting up for another Taper Tantrum like move. Recently Rates have been moving upward with voracity and currencies have become more volatile, stocks are still the odd man out when it comes to the volatility though. BAML in last nights “Situation Room” highlighted the set up in some of these assets for a Taper Tantrum like move:

I personally think that we will see this move when the Fed hikes rates, but that can happen whenever so I m not going to take a timing pick on it. This move across assets is very interesting and should get investors thinking about how their portfolios are balanced and if they can handle these moves without calling up their broker trying to get out.

What Im Reading This Morning

http://www.wsj.com/articles/icap-weighs-treasurys-trading-collars-1433285708 (WSJ)

http://advisorhubinc.com/wall-street-is-still-way-too-bearish-on-stocks/ (AdvisorHub/TRB)

http://www.businessinsider.com/jamie-dimon-is-a-billionaire-2015-6

My friends reaction to ECB interest rate decision today:

borrriiiing http://t.co/ONUyLc1Zt8—

Jere Wilkinson-Smith (@JeremyWS) June 03, 2015