Morning Market Thoughts

Morning Market Thoughts:

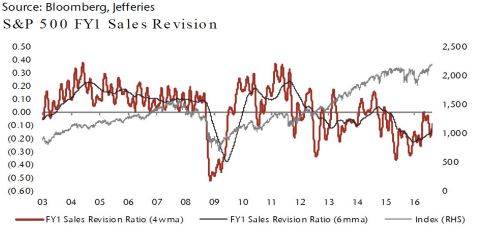

This morning I was reading a piece from Jefferies global equity team. I tend to like their pieces because they are typically two pages long, having some very good facts and stats, and have charts that make you go “Hm”. Earnings now wrapping up to the final few companies reporting, Jefferies had a rather good chart on the S&P 500’s sales revision ratio both on a 4 week moving average and a 6 month moving average. Here it is:

We see that the 4 week moving average has defiantly picked up from the 20015 lows and the 6 month moving average is improving nicely. The question that arises from this chart is Why? Why is this improving? The answer is comes from another chart featured in the Jefferies note:

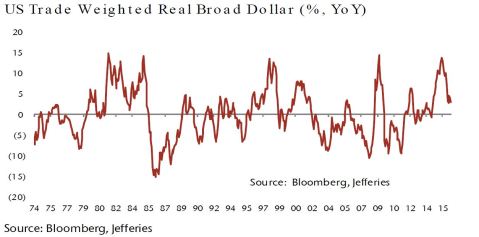

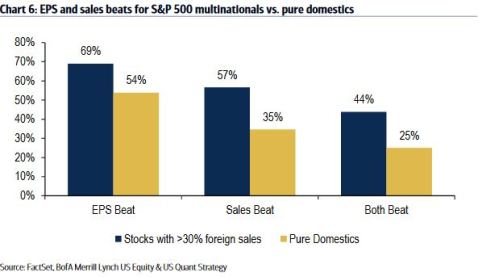

Ah yes! The almighty dollar. Whats so important is that this chart of the dollar is that it focuses of the Year over Year rate of change. We see that there was a sharp move higher from 2014-2015 and that we are starting to get back to that 0% Year over Year change. With this change in the dollar appreciation we have also heard less of the Dollar in earnings calls. I remember over the last two years that the play was to switch into more pure domestic companies so you didn’t have to worry about the dollar affecting earning as much. But now we have a significantly less move in the Dollar on a Year over Year basis and the result……. Not a lot of mentions about the dollar on conference calls and you would have to really search to hear about another fact. That fact is that Multinationals absolutely kicked Pure domestic company’s butt when it came to earnings this quarter, take a look:

It is in my opinion that this lack of move in the dollar is defiantly one of the reasons why earnings were so good this quarter and that we have seemed to emerge from the earnings recession we were in.

Questions and comments are always welcome

WillHassellws@mail.com

Morning Market Thoughts

Some things to read this Morning:

Mohamed El-Erian’s expectations for the Fed Minutes (Bloomberg)

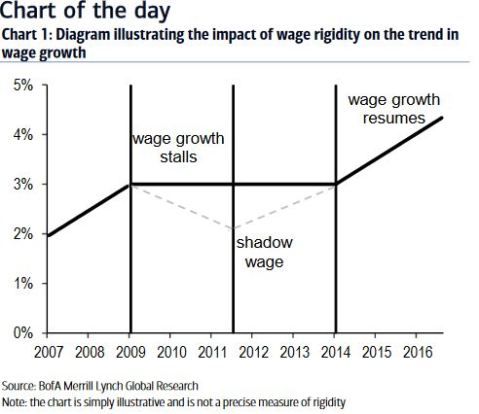

Here is a cool Chart from BAML:

Market Thoughts:

Lately I have a lot of people ask me what equity plays I like in the market. I keep coming back to one play and that is the Russell 2000 ETF the IWM. The IWM is one of the few major indexes that hasn’t hit its All Time High from last June. I like the IWM here has 1-3 month play. Using $122 as a stop and targeting a break out over $13 and then to the all time highs seen last June.

Here we have a chart of the IWM with the yellow line being $123. This level seems pretty key as it has been a level of buying back ion both March 2015 and July 2015. If you remain hesitate of this trade then wait for IWM to close above $123 for a couple days to confirm that the break out is for real.

Market Thoughts: The Trade

Hey everybody! Its been awhile since I have had the time to actually right anything. I keep trying to get back into the swing of writing small, daily, post in the mornings, but I keep putting it off. So here I am writing about the most recent trade I have put on and its kind of a shocker.

I must admit I did not come up with this trade on my own. I had some help from my good friend Alex who is a awesome trader, he know options better than most professionals and you can follow him on twitter @InvestmentKId. I came to him asking about VIX trades (VIX is the CBOE S&P500 volatility index). With the VIX in the 11s O figured it would probably be time to put a trade on because the VIX almost always ends up rising when it is below $12. With this in hand I began a long conversation with Alex about trade ideas for VIX; explaining that I wanted to only risk $400 on this so if it didn’t work out it didn’t hurt me too bad. Alex quickly educated me on why a trade on the VIX was not the best play. He suggested a trade he was in if I wanted to put on a hedge, like buying the VIX, but would have a better payoff if it worked.

The trade was a Broken wing butterfly in the SPX or the S&P500 index. Here is what the trade looked like on the order form:

You can see here that I would be buying and selling some in the money puts for the SPX. I did end up getting the trade for my limit price. For those, like myself, who better understand options based on the graphical representation here you go:

Here we see that if the SPX ends up being at $2,000 on September 16th expiration I can make a max of $9,625 with risking only $375. That is a pretty low probability. On this chart you see that it actually doesn’t even give it a probability. On the max loss side we see its the $375 I paid for this spread; with a probability max loss of 97.96%. This does have a risk reward of 1 to 25.67 which is nice if it actually happens. The goal of this trade is to have a decent hedge for my portfolio. So I am fine with having $375 hedge that must likely will go to zero, but can protect thousands in long exposure if something goes on.

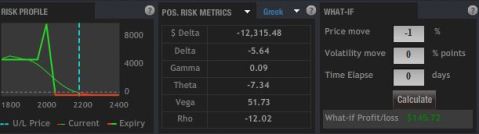

Now what is nice about this trade is that if the SPX does go down 1% on a day you will make about 50% of what you paid for the trade. you can see that here on the Optionhouse “What if Calculator” :

To wrap it this up the reason I got into this trade is that we are at all time highs for the S&P 500 and I wanted to buy some protection at a price where if I could lose it all and not really mind too much. Im not suggesting everyone rush into this trade, but it is a decent alternative to buying calls on the VIX.